Regardless of where you come down on the Trump Administration's ongoing tariff battle with China, the U.S. home theater market needs China. Therefore, it would be devastating to at least some, if not all, U.S. manufacturers of TVs, speakers, and other home theater devices--as well as at least some of the retailers who sell them--if the Trump Administration actually decides to invoke the 1977 International Emergency Economic Powers Act (IEEPA) as he's threatened to do. Especially if he forces manufacturers to make the change immediately.

Trump's Aug. 23 tweet, in which he "hereby ordered" American companies "to immediately start looking for an alternative to China," was likely at least partially responsible for U.S. stocks tumbling significantly that day. After all, the comment created a mountain of uncertainty for U.S. companies, and investors hate uncertainty. Among the unanswered questions: How long manufacturers had to actually find an alternative channel, assuming this wasn't just another effort by Trump to get China to get back to the negotiating table. Did manufacturers have a week to comply with the "order"? A month? A year? By the end of Trump's presidency?

Trump's Aug. 23 tweet, in which he "hereby ordered" American companies "to immediately start looking for an alternative to China," was likely at least partially responsible for U.S. stocks tumbling significantly that day. After all, the comment created a mountain of uncertainty for U.S. companies, and investors hate uncertainty. Among the unanswered questions: How long manufacturers had to actually find an alternative channel, assuming this wasn't just another effort by Trump to get China to get back to the negotiating table. Did manufacturers have a week to comply with the "order"? A month? A year? By the end of Trump's presidency?

One major reason for concern is the simple fact that there's an awful lot of home theater products that come from China, as pointed out by Rick Kowalski, senior manager of industry and business intelligence at the Consumer Technology Association (CTA). That includes TVs, finished speakers, soundbars, and DVD/Blu-ray and Ultra HD Blu-ray players, he said.

Although TVs tend to be the home theater products cited most when discussing this issue, amusingly enough, they stand to be impacted the least of those categories in terms of the sheer percentage of products that are coming from China, according to CTA data provided by Kowalski. Of the TVs imported into the U.S. in 2018, products from China accounted for 35 percent of them, compared to 38 percent of soundbars, 53 percent of the video optical disc players, 69 percent of one classification of finished speakers under the Harmonized Tariff Schedule (HTS) code (85182100), and a whopping 73 percent of a second classification of finished speakers under the HTS code (85182200).

Although TVs tend to be the home theater products cited most when discussing this issue, amusingly enough, they stand to be impacted the least of those categories in terms of the sheer percentage of products that are coming from China, according to CTA data provided by Kowalski. Of the TVs imported into the U.S. in 2018, products from China accounted for 35 percent of them, compared to 38 percent of soundbars, 53 percent of the video optical disc players, 69 percent of one classification of finished speakers under the Harmonized Tariff Schedule (HTS) code (85182100), and a whopping 73 percent of a second classification of finished speakers under the HTS code (85182200).

However, Kowalski said: "These are just the largest categories. TVs are impacted on a few other HTS codes but the one above is by far the largest." Regardless, in terms of value among those home theater product categories, TVs accounted for by far the most money, at $4.5 billion, ahead of $849.6 million for one finished speaker category, $461.5 million for the other finished speaker category, $541.4 million for video optical disc players, and $52.6 million for soundbars. Any way you slice it, we're talking about billions of dollars of home theater products that would be impacted by a requirement that U.S. manufacturers stop doing business with China.

While some manufacturers have already started looking for alternative sources for their products outside China, the key takeaways from the manufacturers and analysts I spoke to in recent weeks are that: (1) It takes a long time to actually shift production to another country entirely. (2) Such a move is going to inevitably increase the prices of at least some products further. (3) There is just no direct alternative in other countries in certain cases. (4) Even if manufacturers do manage to shift all their production to another country, at least some of them are concerned that Trump could start a similar trade war with Vietnam, Mexico, or any other country that they shift production to. After all, China is hardly the only country that he's singled out already.

"Ramping up production in a new factory takes time as samples have to be made," added Roy Hall, president of Great Neck, N.Y. audio manufacturer Music Hall, which specializes in products including audiophile turntables. "This sometimes takes a full year to get it right," he told me, adding: "Europe is more expensive but has the cachet of not been made in China."

"Ramping up production in a new factory takes time as samples have to be made," added Roy Hall, president of Great Neck, N.Y. audio manufacturer Music Hall, which specializes in products including audiophile turntables. "This sometimes takes a full year to get it right," he told me, adding: "Europe is more expensive but has the cachet of not been made in China."

"The tariffs are hurting me, not China," he said, noting he already paid more than $20,000 in tariffs, which caused him to increase prices on two products, including one of them he increased by 25 percent. "I think the new price will dramatically reduce sales of that item," he said, adding he "will be making more products in Europe but that is in the long term; in the short term, I will still be buying products from China." According to his company's website, Music Hall "manufactures its own range of turntables in the Czech Republic," but its "electronics are developed and designed in the U.S. and manufactured to our strict specifications in Shenzhen, China."

"If the idiot declares a national emergency, then we are all f***ed, as the amount of business the U.S. does with China is massive," he went on to say, adding: "Look how the farmers and now car companies are hurting because of the trade war. Just wait until all imports are banned and it hits every section of the market."

Gary Yacoubian, president and CEO of audio manufacturer SVS, said he doubted he would have to move production of his company's products out of China, calling the concept "completely ridiculous." Noting a large percentage of his company's products are made in China, he told me: "Of all the different things I prepare for, that's not one of them." Although Yacoubian realizes that the Trump administration could invoke IEEPA, he said: "I hope it doesn't," adding that although he was concerned about the situation, including the latest tariffs, he was also "kind of hopeful" that the U.S./China trade war could be negotiated and come to a conclusion. In the meantime, "we're looking carefully at our alternatives [but] I'm not going to build a factory," so it comes down to whether or not a manufacturing partner of his can make the move.

Gary Yacoubian, president and CEO of audio manufacturer SVS, said he doubted he would have to move production of his company's products out of China, calling the concept "completely ridiculous." Noting a large percentage of his company's products are made in China, he told me: "Of all the different things I prepare for, that's not one of them." Although Yacoubian realizes that the Trump administration could invoke IEEPA, he said: "I hope it doesn't," adding that although he was concerned about the situation, including the latest tariffs, he was also "kind of hopeful" that the U.S./China trade war could be negotiated and come to a conclusion. In the meantime, "we're looking carefully at our alternatives [but] I'm not going to build a factory," so it comes down to whether or not a manufacturing partner of his can make the move.

There is no way that manufacturing in China is going to disappear, according to Paul Gray, associate director at research firm IHS Markit. Although "there are already moves to cheaper locations," including Vietnam, by U.S. manufacturers because "wages in coastal China are not the cheapest anymore," he said China still has a "complete supply chain and full network of contractors, component vendors, etc., and moving away will not be easy--anywhere else will demand extra support." At a 15 percent tariff, Mexican assembly "starts to be competitive, but it will require investment and training to expand from its current level, he said. Plus, "if a Mexican factory extension is a two-year project, what confidence do companies have that the Tariff regime will be the same then?" he pointed out.

There is no way that manufacturing in China is going to disappear, according to Paul Gray, associate director at research firm IHS Markit. Although "there are already moves to cheaper locations," including Vietnam, by U.S. manufacturers because "wages in coastal China are not the cheapest anymore," he said China still has a "complete supply chain and full network of contractors, component vendors, etc., and moving away will not be easy--anywhere else will demand extra support." At a 15 percent tariff, Mexican assembly "starts to be competitive, but it will require investment and training to expand from its current level, he said. Plus, "if a Mexican factory extension is a two-year project, what confidence do companies have that the Tariff regime will be the same then?" he pointed out.

The one industry expert I spoke with who said U.S. manufacturers could get by without China was Robert Heiblim, chairman of the CTA's Audio Division and a partner at consulting firm Bluesalve Partners. "Of course, firms could possibly end all business with China," he said, but added: "The question is why?" And he was quick to stress that it wouldn't be simple, especially for smaller companies.

The one industry expert I spoke with who said U.S. manufacturers could get by without China was Robert Heiblim, chairman of the CTA's Audio Division and a partner at consulting firm Bluesalve Partners. "Of course, firms could possibly end all business with China," he said, but added: "The question is why?" And he was quick to stress that it wouldn't be simple, especially for smaller companies.

"One has to keep in mind that the supply chains and manufacturing processes in place are the result of over 30 years of development," he said, explaining: "This means they are now the most efficient both in production and cost, as well as timing. Moving away from there has a lot of impact. In general, it is nearly impossible for many firms and products to move in short order. For example, for Apple they could perhaps move as much as five to six percent of their production out of China within 18 months or so. It would take them until 2022 to move about 25 percent or the amount needed for U.S. consumption. And this is for one of the largest, most advanced companies, indicating just how hard it is. Apple can get suppliers to build facilities around the world and has a diversified manufacturing base already."

A shift away from China to another country would be "much more difficult" for small companies, he said. That's because the "manufacturing basis of their products may be limited and in many cases almost all of certain product types are built in China at this time, [so], to move them would require years of time and also investment to build new supply chains, train labor, and other factors," he noted, adding: "Many small firms do not have the capital to do this, so they would have to wait for it to be built."

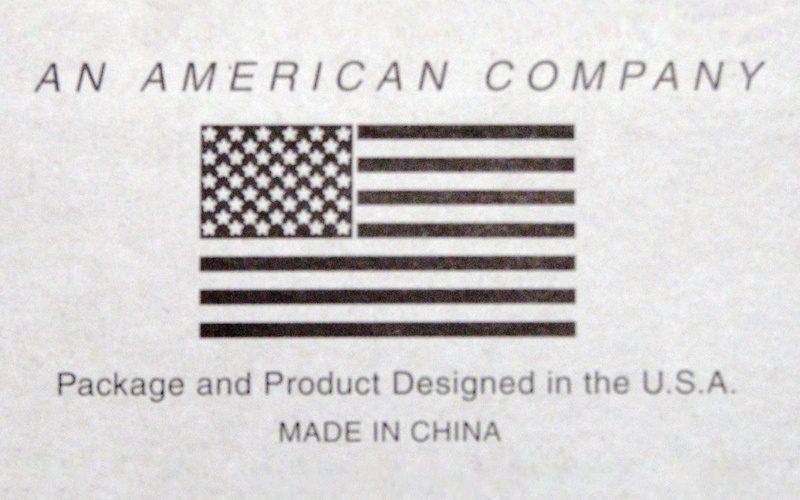

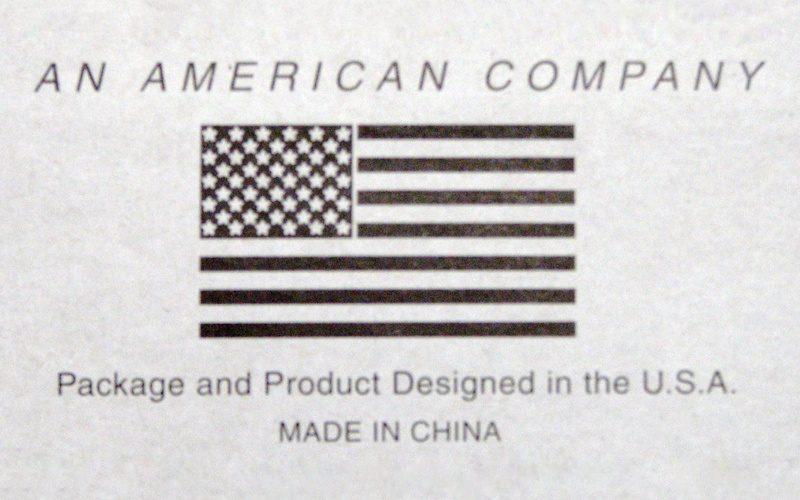

Even if manufacturers indeed opted to shift their production to other countries, it would still, however, not mean leaving China entirely, because "many of the components would still be sourced there," he pointed out. Many so-called "manufacturers" in the U.S. also actually "outsource all or part of their production to China: Certainly, the component parts, so many loudspeaker inputs are tariffed," for example, he said.

Meanwhile, one of the "real challenges of bringing production back to the U.S. is the lack of a supply chain" here, he said, recalling how Harman Kardon co-founder Sidney Harman "complained that plastic volume knobs were among the reasons he could no longer produce some items" here. That part, which is just a penny or so in China, was "costing real money here as it not only cost more than 10 times as much, but had to be shipped multiple times to get to production," so it was too expensive to use, Heiblim said. "Yes, luxury goods where price is less sensitive can be built here, but then may be uncompetitive in the wider global markets due to cost factors," he said, adding that's "why we have seen consistent moves even in that community to source more efficiently" and so even high-end product makers manufacture in China.

Also, how could any manufacturer determine what a "safe" place to build products would even be, he asked. "If the measure is trade deficit, Vietnam, Thailand, Malaysia, and other likely spots also have trade deficits with the U.S., meaning they too could fall under increased tariffs if the rule is followed," he noted.

So, moving home theater device production out of China "certainly can be done, but the impact may be price increases and in many cases quality decrease," he said. "You see, it is not just cheap labor (and it is not that cheap anymore) but low input costs, and efficient manufacturing that makes it attractive. It will take years of development for other countries to match this. So, the result will be price increases and perhaps loss of global share due to price impacts as the rest of the world will keep buying from the most efficient supply chains," he explained.

Like many other industry executives and analysts, he wasn't arguing that China wasn't guilty of intellectual property theft or that trade shouldn't be made fairer. But he said: "Decisions made over 30 years ago to try to bring China into the world order made this situation, and it will take time to unwind."

On a somewhat bright note, to be fair, although almost all types of products stand to be impacted by the latest round of Trump tariffs--which means U.S. consumers face increased prices on nearly everything they buy--many of the higher-end TVs and other devices that are made in Mexico and not China stand to be significantly less impacted by the current China/U.S. trade battle. And, perhaps more importantly, while U.S. consumers must buy food and clothing to get by and survive, we really don't need to have a new TV, stereo receiver, or set of speakers. So, the worst-case scenario--for consumers anyway--is that we just wait for this whole trade battle to blow over before buying products for our home theater systems. Only problem is, at this rate, we may be waiting a long time.

Additional Resources

• The Impact of Trump's Tariffs & Tax Cuts on the CE Industry at HomeTheaterReview.

• Trump's Technology Tariffs Create Continued Uncertainty for the AV Industry at HomeTheaterReview.

• Technology Tariffs Having a Mixed Impact on Consumers So Far at HomeTheaterReview.